Content

Filing your taxes as early as possible allows you to get a faster refund. It can also help protect you against identity theft. The earliest the IRS accepts tax filings is the end of January.

Find free options to get tax help, and to prepare and file your return on IRS.gov or in your community if you qualify. Go to IRS.gov and click on the Filing tab to see your options. Fortunately to offset double taxation US citizens or residents living abroad can take advantage of the foreign earned income exclusion and foreign tax credit while filing their US tax return. I recommend you use online tax software like, TurboTax, to help you with filing the correct forms. The IRS usually begins accepting tax returns at the end of January every year.

Tax Filing Schedule for Filing 2022 Returns or Extensions

Fees for other optional products or product features may apply. DE, HI and VT do not support part-year/nonresident individual forms. Most state programs available in January; software release https://quick-bookkeeping.net/ dates vary by state. State e-File for business returns only available in CA, CT, MI, NY, VA, WI. Change or amend a filed and accepted tax return, learn how to amend a federal tax return.

How long does it take to get a tax return from the Netherlands?

Dutch income tax return due date

Your Dutch income tax return is due by 1 May following the fiscal tax year. Income tax return filings submitted before 1 April will be processed by the Dutch tax office within three months.

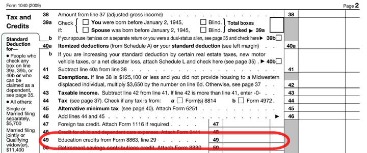

If you file a joint return, each spouse who qualifies can claim the additional amount. If you are both 65 or older and legally blind, When Is The Earliest You Can File Your Tax Return? you can claim twice the additional deduction. But check the IRS, “Where is my refund tool” from IRS.gov to get the latest status.

Tax Deadlines for Filing 2021 Returns

File as soon as you have all your W-2s and other income information. E-filing is the safest way to file, as e-filed tax returns are specially encrypted for extra security. Go toDOR personal income tax forms and instructionsto file by paper. If you want your refund right away, don’t mail a paper return.

Description of benefits and details at hrblock.com/guarantees. Wondering how you can get a copy of your W-2 online? With H&R Block’s free W-2 Early Access℠ service, you can get your W-2 online for free and have an electronic copy sent to your local H&R Block office.

The Tax Filing Deadline

The IRS won’t send you one refund for $1,000 and hold the EITC portion of your refund until mid-February if you overpaid $1,000 in taxes and are also entitled to a $1,000 EITC refund for a total of $2,000. It is said that the early bird catches the worm and in this case the worm is a tax refund. We’ll let you decide whether the early bird is the person filing their taxes or the IRS. Something for you to mull over for the rest of the day. There are several different tax deductions and credits that can help you get the largest refund.

- Go toFind a tax professional to help with your taxes.

- If you have more than $10,000 in a foreign bank account, you must file the Foreign Bank and Financial Accounts, or Form 114, by this date.

- Employers must send W-2s and 1099s by January 31st of the following tax year.

- Here are some common credits and deductions that can help you lower your tax bill or receive a refund.

- If you get a larger refund or smaller tax due from another tax preparer, we’ll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid.